LCI Workers’ Comp

Helping an Industry Leader Modernize for the Future

Louisiana Construction and Industry Workers’ Comp (LCI) provides workers’ comp coverage to 4,000 small and medium-sized businesses across Louisiana. The group self-insurance fund has been in operation for over 30 years.

project brief

Outdated Systems. Competitive Pressure. Evolving Expectations.

As the workers’ comp industry has evolved, so too have agent and customer expectations for speed, transparency, and self-service. LCI’s existing custom-built systems had served them well for many years, but were beginning to show their age—and risked falling behind competitors who were investing heavily in automation and modern user experiences.

LCI needed a long-term technology partner who could help modernize core systems in a way that would preserve the fund’s flexibility and service model while positioning them for future growth.

The Product Managers at LookFar Labs have the ability to translate our business needs to a tech solution in a way that we could not do without them.”

Solution

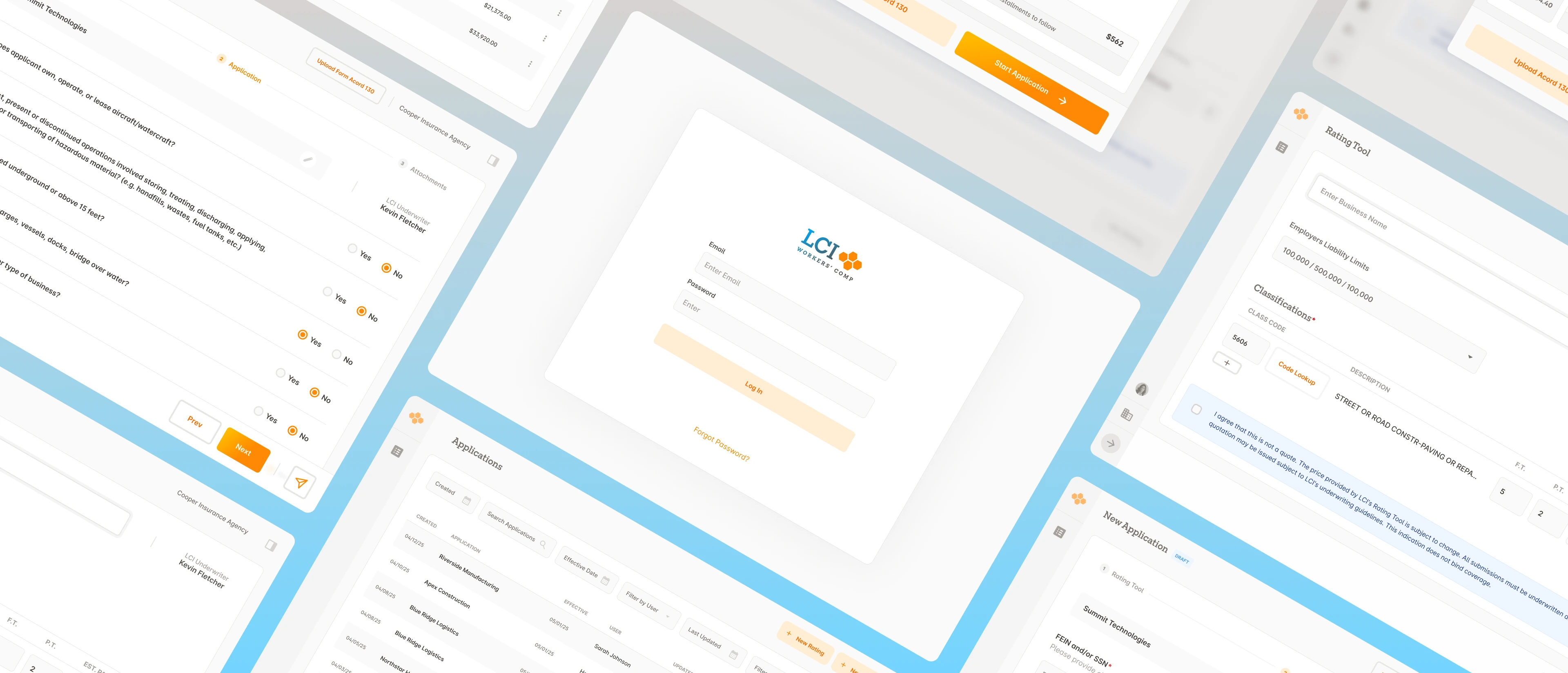

Over the past decade, we’ve partnered with LCI to design and build a suite of web-based products that support every aspect of their business

—from claims and underwriting to policy management, billing, and beyond.

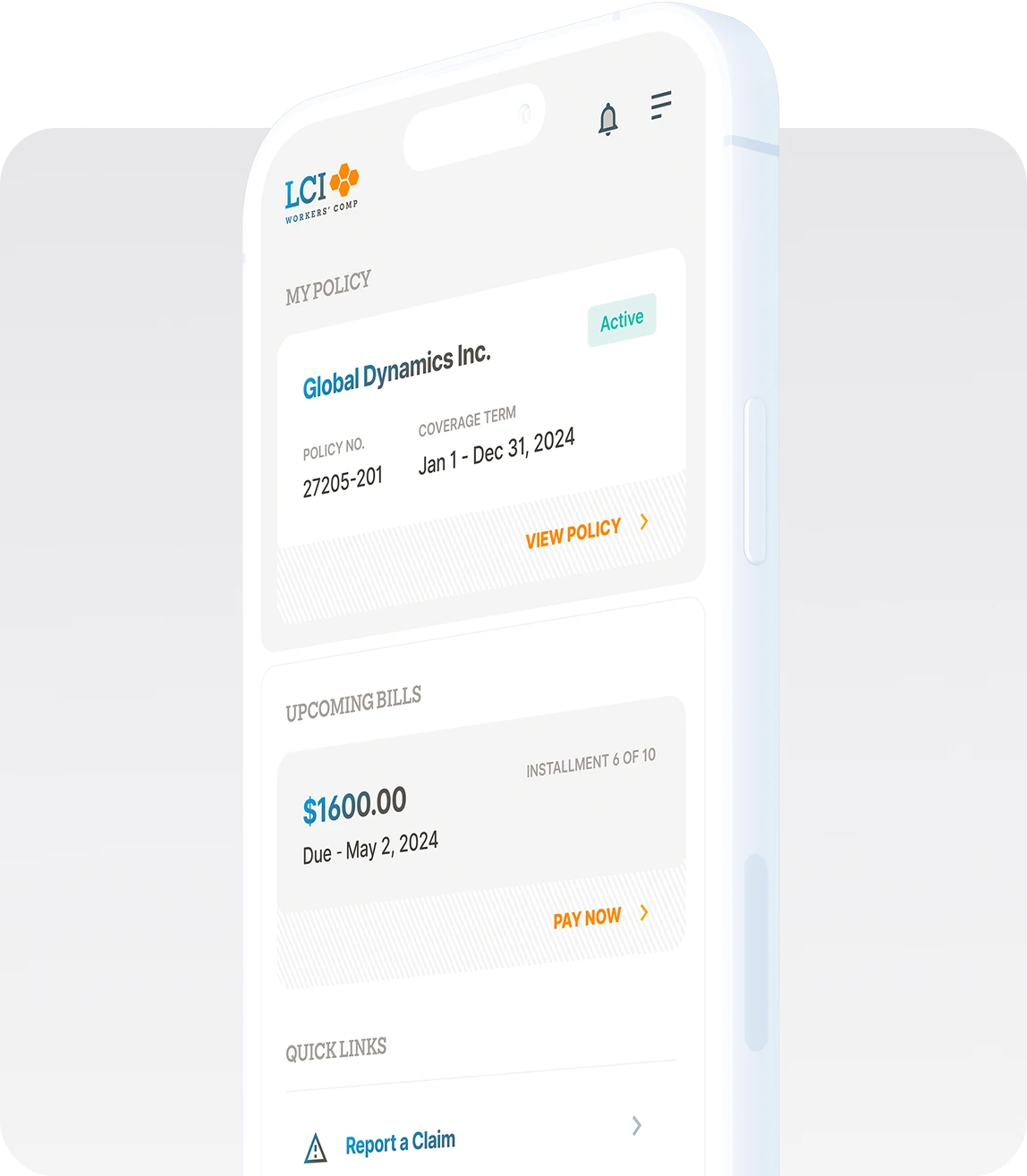

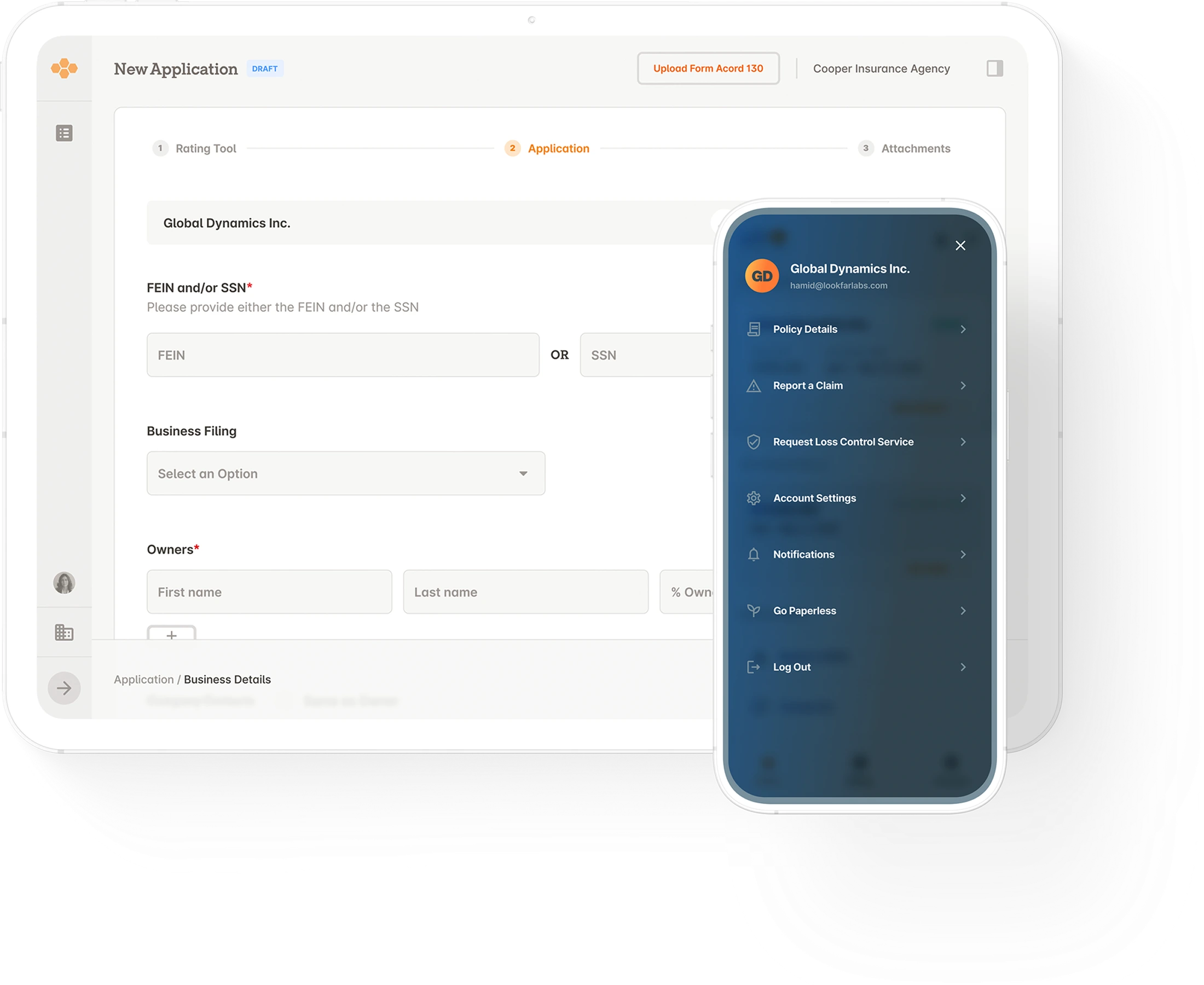

Through ongoing collaboration, user interviews, and deep process analysis, we’ve helped streamline complex workflows and ensure that key data flows securely across LCI’s various business functions and vendor integrations. Specialized portals now provide tailored access for Members, Agents, and Attorneys—supporting both operational efficiency and a better user experience.

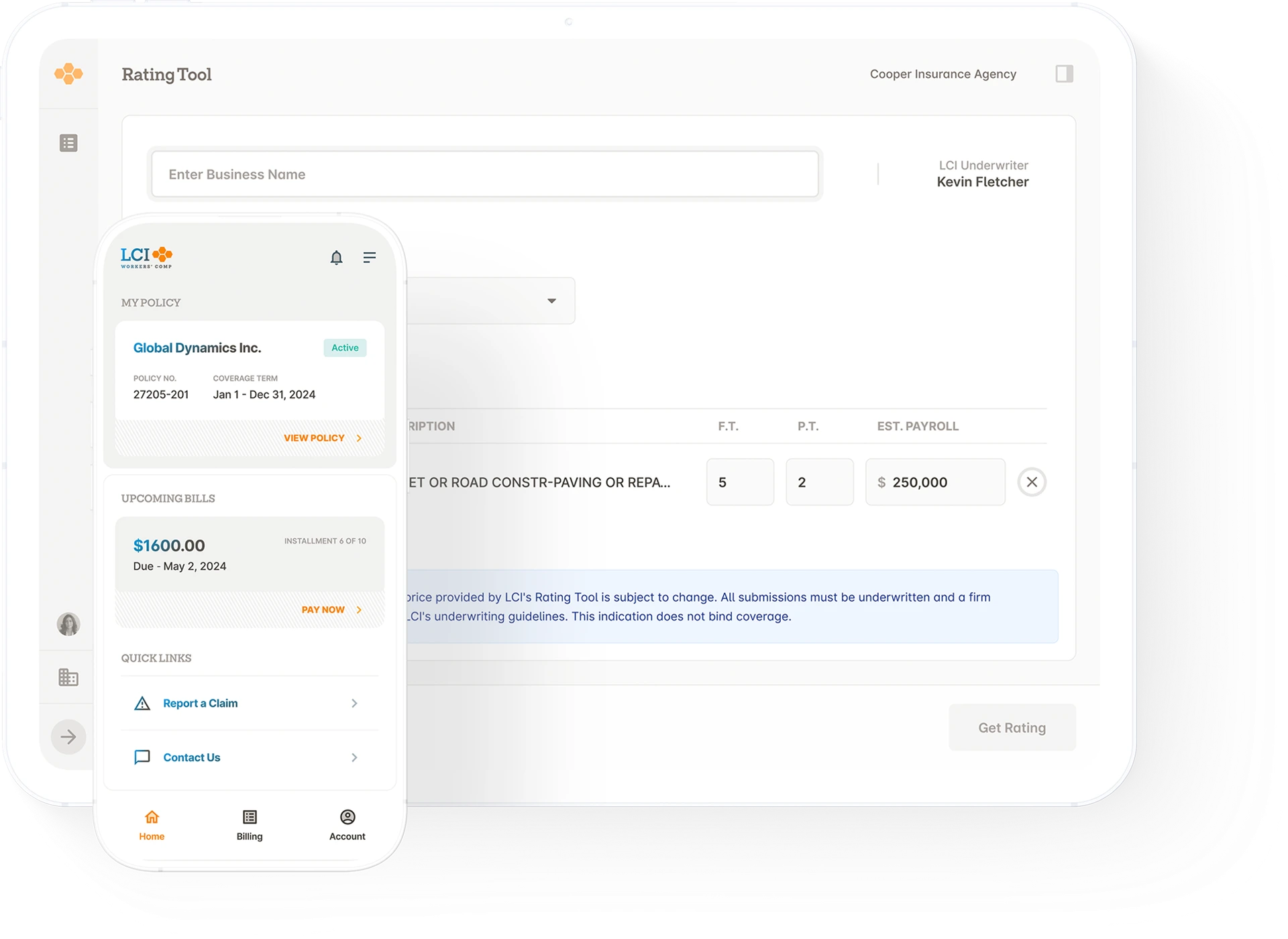

Most recently, we developed the Submissions Portal, a modern application workflow for insurance agents. The portal includes a Rating Tool that allows agents to quickly obtain an initial coverage estimate. If the agent decides to proceed, all of the data captured in the Rating Tool carries forward into the full application process, including ACORD 130-compliant data and any necessary supplemental business information.

The impact of this system has been significant: within just four months of launch, one underwriter reported that 75% of new applications were being submitted through the portal—dramatically improving the underwriting workflow and creating a faster, more seamless experience for agents.

Results

Key Outcomes:

Modern architecture

Powers scalable, future-ready systems across core insurance operations

Agent submission workflow

Drives 75% of new applications through the streamlined Submissions Portal

Operational efficiency

Enables faster, more integrated underwriting, policy management, claims, and billing

Agent experience

Delivers rapid estimates and a simplified digital application process through the Rating Tool

Strategic modernization

Positions LCI to stay competitive and responsive in an evolving insurance market

Our long-term partnership with LCI demonstrates how targeted, business-first modernization can deliver real results. By rebuilding core systems and improving key workflows, we’ve helped LCI operate more efficiently, serve agents more effectively, and position the organization for continued growth in an increasingly competitive market.